Corporate governance

- HOME

- Corporate Information

- Corporate governance

Corporate governance

1.Basic View

Corporate governance in the Company is based on our Values. To build good relationships with stakeholders with whom we have various interests and become a company that continues to be trusted, we believe it is essential to build a system that functions to enhance management transparency and fairness to enable prompt decision making that leads to sustainable growth and increased corporate value.

2.Values

There are five "CKD Values" that each and every CKD Group employee share and value for realizing the Purpose.

C-SHIP, which stands for Customer, Sustainability, Human, Innovation, and Professionalism, is an abbreviation of CKD-SHIP and indicates the "character of CKD" or "CKD-ness".

Customer “Customer first”

We will grasp our customers' true concerns and deliver excitement through solutions that create new value.

Sustainability

Together with our stakeholders, we aim to realize a sustainable global environment and society

Human “Human resource”

We will build a happy future by cultivating ourselves and joining forces with our diverse colleagues.

Innovation

We will break out of the shell of common sense and constantly evolve through challenge and co-creation.

Professionalism

We will continue to be an irreplaceable presence by enhancing our professional capabilities and producing results that exceed expectations.

3.Basic Policy on Corporate Governance

4.Corporate governance organization

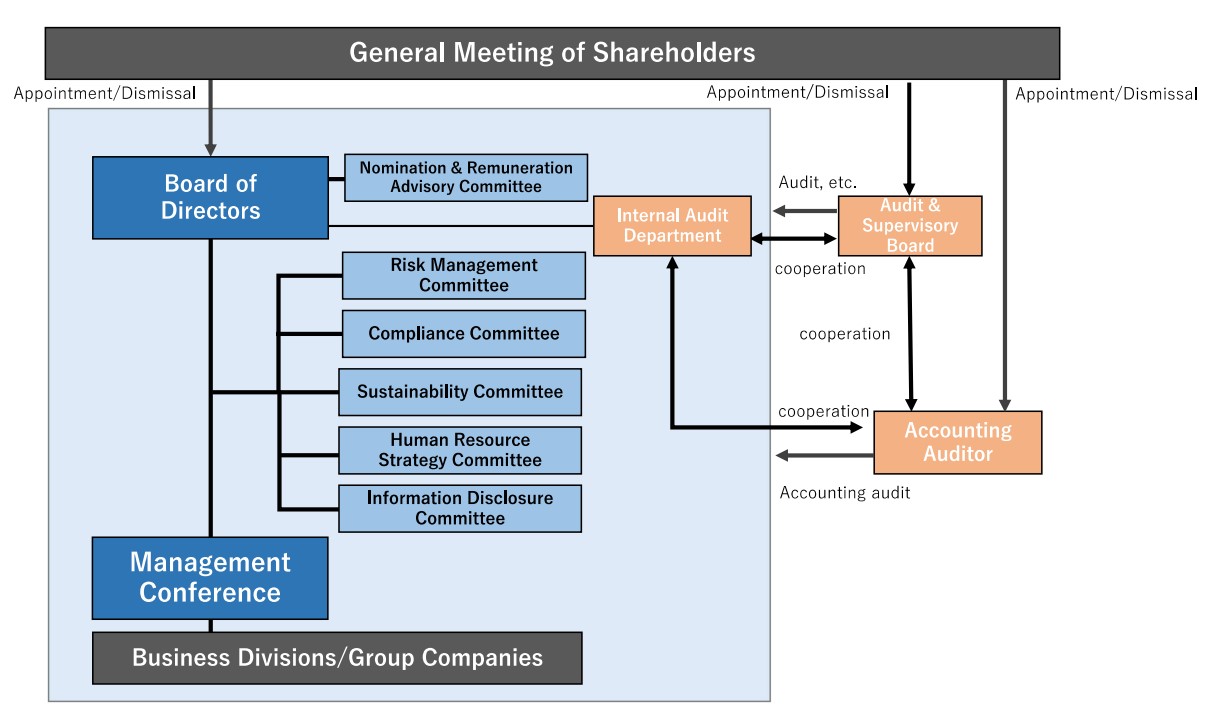

To ensure transparency, soundness, and efficiency of management, we have established the following bodies within the framework of a company with a board of company auditors to establish a system with the aim of enforcement of oversight, audit, and decision-making functions, and swift execution of operations.

5.Corporate Governance Report

6.Matters Regarding Directors

1.Board of Directors and Audit & Supervisory Board Members

Click here for Board of Directors and Audit & Supervisory Board Members

2.Evaluating the effectiveness of the Board of Directors

Toward sustainable growth and increased corporate value, the Company regularly examines matters such as the composition of the Board of Directors and its operations as well as the support structure for Directors and Audit & Supervisory Board Members, so that the Board of Directors fulfills its roles and responsibilities effectively.

The results of the survey confirmed that the Board of Directors conducts free, open, and constructive discussions and exchanges views not as mere formality, that information necessary for Directors and Audit & Supervisory Board Members to execute their duties is being provided appropriately, and that the Board’s overall effectiveness is secured. The Company will also further enhance opportunities for deliberation and provision of information on management strategies and plans.

The Company aims to further increase the effectiveness of the Board of Directors referring to these evaluation results.

・Main contents of the survey

- Respondents

- All members of the Board of Directors (Seven Directors and four Audit & Supervisory Board Members)

- Evaluation method

- Anonymous questionnaire

- Summary of questions

- ・Composition of the Board of Directors

・Management of the Board of Directors meetings

・ Discussion at the Board of Directors meetings

・Monitoring function of the Board of Directors・Training

・Dialogue with shareholders (investors)

・Self-improvement

- Aggregation of results

- Outsourced to ensure objectivit

・The results of the Board of Directors' effectiveness assessment in FY2021 are reflected in the initiatives for FY2022.

| 2022 | ||

|---|---|---|

| Assessment Item | Tasks | Initiatives |

| Operation of the Board of Directors | Ensure sufficient time for discussion amidst the large number of matters to be deliberated. | Clarify the division of deliberations between the Corporate Board and the Board of Directors and ensure sufficient time for discussion of important management strategies. |

| Board discussions | Ensure sufficient discussion on various matters related to management strategies, management plans. | Increase opportunities to discuss and report on medium- and long-term management strategies. |

| Sufficient supervision and monitoring | Adequate supervision and monitoring of the operation of the Group-wide internal control system | Newly established Risk Management Office to ensure that audit plans, audit reports and opportunities for discussion are carried out. |

| Dialogue with shareholders | Adequate feedback on the status of dialogue with shareholders and investors is required | Continue to share information on dialogue with shareholders and investors and ensure opportunities for further in-depth discussions |

3.Remuneration system

The Nomination & Remuneration Advisory Committee, an advisory body to the Board of Directors, deliberates on the remuneration system for officers and establishes the following basic policies:

- Design the system to motivate officers to contribute to the enhancement of corporate value

- Ensure the appropriateness of the method for determining and distributing remuneration

- Design the system to allow officers to share interests with shareholders through stock ownership

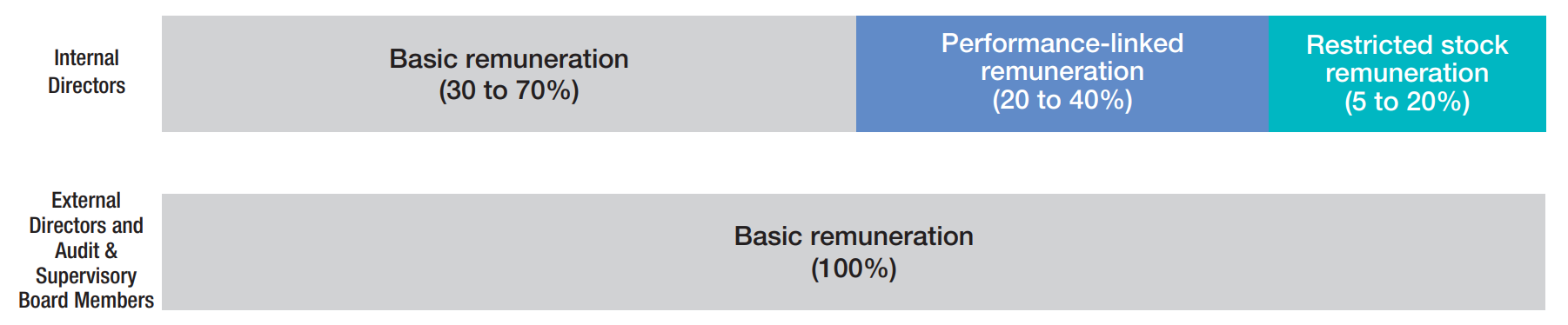

Remuneration for Directors consists of basic remuneration, performance-linked remuneration, and stock remuneration. The ratio of Directors’ remuneration by type is designed so that the higher a person’s position, the greater the proportion of performance-linked remuneration. External Directors who are responsible for the oversight function, are paid only basic remuneration, in light of their role.

The determination process and details shall be within the range approved by the General Meeting of Shareholders (Note 1) and shall be in accordance with the recommendation from the Nomination & Remuneration Advisory Committee, in which chaired by an independent External Director, to further increase transparency.

With regard to the performance indicators for performance-linked remuneration, in fiscal 2020, the achievement rate for each of the evaluation indicators for consolidated sales, consolidated operating income, ROE, and development investment for the previous fiscal year linked to the Medium-Term Management Plan, ranged from 30% to 70%.

Restricted stock remuneration has been granted since fiscal 2018 with the aim of further raising motivation to contribute to sustainably improving corporate value and shareholder value over the medium to long term within the range approved at the General Meeting of Shareholders (Note 2). In fiscal 2020, a total of 9,570 shares were granted to four (4) Directors excluding External Directors, which accounted for approximately 8% of their remuneration.

The amount of remuneration for Audit & Supervisory Board Members is determined by the Audit & Supervisory Board within the range approved at the General Meeting of Shareholders (Note 1). To ensure their independence from management they are only paid fixed remuneration.

(Notes) 1.According to a resolution passed at the 87th Annual General Meeting of Shareholders held on June 28, 2007, the maximum amount of remuneration is set as follows:

Directors of the Board: Up to 600 million yen per year

Audit & Supervisory Board Members: Up to 80 million yen per year

2.According to a resolution passed at the 98th Annual General Meeting of Shareholders held on June 22, 2018, the maximum amount separate from the existing monetary remuneration framework is set as follows:

Directors of the Board: Monetary compensation receivables of up to 120 million yen per year

| Type of remuneration (composition ratio) |

Remuneration details |

|---|---|

| Basic remuneration (about 30 to 70%) (Note) |

・The amount is fixed by position according to responsibilities determined upon comprehensive consideration while referring to the levels of employees’salaries and remuneration levels at other companies. |

| Performance-linked remuneration (about 20 to 40%) (Note) |

・To raise awareness on improving performance each fiscal year, performance-linked remuneration is paid in cash in an amount reflecting the results of the performance indicator in the previous fiscal year. ・The target performance indicator and its amount are consulted with the Nomination & Remuneration Advisory Committee as necessary in accordance with changes in the environment and are reviewed based on its recommendations. ・Officers other than those with titles are eligible for bonuses, to be paid at a certain time each year in an amount obtained reflecting the degree of targets achieved for each individual. |

| Restricted stock remuneration (about 5 to 20%) (Note) |

・Restricted stock remuneration consists of restricted stock intended to further raise motivation to contribute to sustainably improving corporate value and shareholder value over the medium-to-long-term within the range approved at the General Meeting of Shareholders. ・The number of shares to be granted to Directors is resolved by the Board of Directors. ・The restrictions on shares are lifted when the Director retires. |

(Note) If there is a pronounced decline in performance, performance-linked remuneration and stock remuneration may fall below the stated range.

Therefore, basic remuneration may surpass the stated range.

4.The policies and procedures for nomination

* Please refer to the Corporate Governance Report [Principle 3-1. Enhancing information disclosure]

The policies and procedures for nominating candidates for Directors and Audit & Supervisory Board Members are set forth in internal regulations, and the selection criteria are based on factors such as excellent character and insight, and extensive knowledge and experience in corporate management. Directors and Audit & Supervisory Board Members are subjected to dismissal if they are not deemed to be contributing to the improvement of corporate value, or if there is misconduct in the execution of duties from the perspective of corporate governance or a material violation of laws and regulations. Such decisions are made by the Board of Directors after consultation with the Nomination & Remuneration Advisory Committee.

Candidates for Audit & Supervisory Board Members are determined with the consent of the Audit & Supervisory Board in advance.

5.Criteria for Judging Independence

The Company deems an outside officer or a candidate for outside officer to be independent from the Company if the officer or the candidate are judged to have no risk of generating conflicts of interest with ordinary shareholders of the Company. “No risk of generating conflicts of interest with ordinary shareholders of the Company” refers to the case where an outside officer or a candidate for outside officer is deemed not to fall under any of the following items.

(1) A person for which the Company and/or its affiliate is a major business partner

(2) A major shareholder (Note 1) of the Company or a person executing the operations (“Executing Person”) thereof (Note 2)

(3) A person in which the Group holds 10% or more of the total voting rights directly or indirectly, or an Executing Person thereof

(4) A major business partner (Note 3) of the Group or an Executing Person thereof

(5) A person who belongs to an audit firm which is an Accounting Auditor of the Company or its consolidated subsidiary

(6) A consultant, an attorney, a certified public accountant, or a person providing other professional services who has received a large amount of money or other assets (Note 4) from the Group, other than as compensation for being a Director or Audit & Supervisory Board Member (if the recipient of such properties is a corporation, partnership or any other organization, such as a consulting firm, law office and accounting office, this item applies to any person belonging to such organization)

(7) A person who has received a large amount of donations (Note 5) from the Group (if the recipient of such donations is a corporation, partnership or an organization, this item applies to an Executing Person of such organization)

(8) An Executing Person of a company that elects an Executing Person of the Group as its officer

(9) A person who falls under any of the above items 2 to 8 in the past three (3) years

(10) If a person who falls under any of the above items 1 to 8 is a significant person (Note 6), a spouse or a relative within the second degree of kinship thereof

(11) Other than the requirements set forth in the above, a person who is at risk of generating conflicts of interest with ordinary shareholders and is reasonably deemed to be in a situation where he/she is unable to perform duties as an independent outside officer

(Notes)

1. “A major shareholder” refers to a shareholder who holds 10% or more of voting rights under the name of itself or another person at the end of the most recent fiscal year of the Company.

2. “Executing Person” refers to an executive director, executive officer, operating officer, and a person equivalent thereto and to an employee of a corporation or an organization. A non-executive director shall be also included in the above for the purposes of judging the independence of an Outside Audit & Supervisory Board Member

3. As to “a major business partner,” the significance of such transaction for the Group and for the major business partner shall be assessed using an appropriate index, and an outline of the result thereof shall be disclosed, so that the Company may practically determine the degree of risk of generating conflicts of interest. A major business partner refers to a person who makes payment to the Company that accounts for 2% or more of the Company’s annual consolidated net sales in the most recent fiscal year.

4. As to “a large amount of money and other properties,” the significance of such money and properties for the Group and for the recipient shall be assessed using an appropriate index, and an outline of the result thereof shall be disclosed.

5. As to “a large amount of donations,” the significance of such donation for the Group and for the recipient shall be assessed using an appropriate index, and an outline of the result thereof shall be disclosed.

6. “A significant person” refers to an executive director, executive officer, operating officer or an employee who is in an upper management position such as department manager or higher.

(313KB)

(313KB)